Observations On the Consumer and Retail Earnings

August 15, 2025

As a REIT portfolio manager, the dynamic across the retail landscape is of great interest as it impacts many of the tenants of retail REITs. Moreover, the health of the consumer, who are two-thirds of the US Economy is also worthy of review.

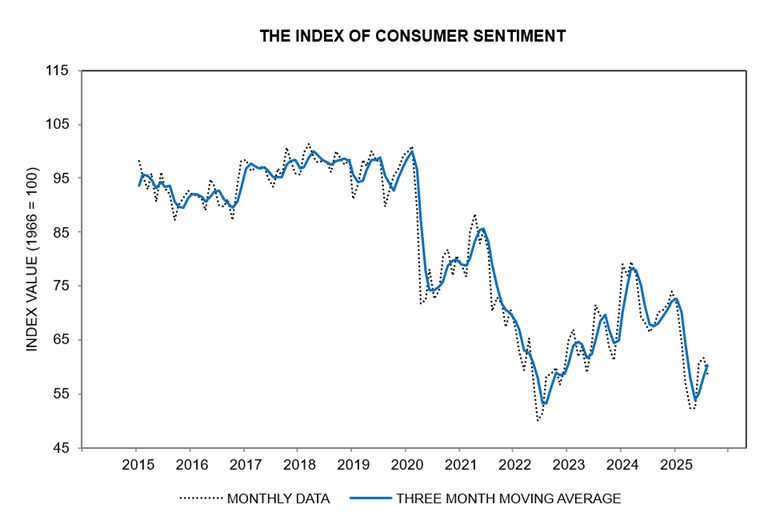

This morning (8/15) the University of Michigan reported preliminary results for consumer sentiment which fell by 5% in August, declining for the first time in four months and has declined 13% Y/Y. This deterioration largely stems from rising worries about inflation according to the survey. The negative impact of COVID lingers as the consumer remains well below pre-lockdown levels.

Source: University of Michigan

Also, out this morning was Core Retail Sales, which were up 0.5% in July, slightly above expectations, while headline spending rose by 0.5%, slightly below consensus expectations. The level of core retail sales was revised up 0.4% in June, reflecting a 0.3pp upward revision to core retail sales growth in June and a 0.1pp upward revision in May. Motor vehicle sales rose 1.6% and gasoline stations sales rose 0.7%, while building material sales declined 1.0%. Core retail sales growth was strongest at furniture stores (+1.4%), sporting goods stores (+0.8%), and non-store (on-line) retailers (+0.8%), and weakest at miscellaneous store retailers (-1.7%) and electronics and appliance stores (-0.6%).

Next week there is a long list of retailers due to report. The early retail reporters of second-quarter earnings have seen some tailwinds, including continued sales momentum exiting the quarter, and some headwinds, such as uncertainty regarding demand elasticity when expected tariff-driven price hikes take effect in late 3Q25 to 4Q25.

The latest annual guidance updates are showing upside relative to prior guidance, but commentary regarding the second half is cautionary. Zooming out to the macro, there seem to be more headwinds than tailwinds—cooling labor market, broad uncertainty including tariffs, and credit card debt growth along with higher delinquencies, which are offset by solid wage growth and lower gas prices. The retail dynamic continues to evolve, while the agility of companies to transform their business models has accelerated.

Some early comments from retail reporting season: Sales in general have beat expectations with cautious guidance for the balance of the year. June quarter end reporters including AMNZ, BRLT, TRUP TSCO and WRBY all cite continued positive momentum into 3Q. The full tariff impact is not yet evident on financial statements and looks to be an issue expected to impact 4Q25 and 2026. Uncertainty about how the consumer will respond to tariff-related price increases expected in late 3Q25 to 4Q25 along with the related demand elasticity are the focus of management. Couple this with the slightly shakier read on the consumer and it looks like the back half of the year could be choppy. There is no “verdict” on the consumer yet this EPS season while there is a lot of dispersion. But product newness along with collaborations and special events look to be important factors driving the retail consumer during 2Q.

Apparel EPS season is just getting started and the initial guides have been looking challenged. Under Armor (UAA) for example, said that even with mitigation efforts and disciplined SG&A management, their profitability is projected to be about half of what it was last year and noted this upcoming quarter will be the toughest quarterly result of the year. This line of commentary along with uncertainty over how consumers will react to escalating prices wat the common thematic across the early reporters.

Notable but not surprising is the reported strength in higher income household’s vs increasing weakness among lower income households. Low income is beginning to feel some pressure, though it’s not yet across the board (feedback is no real change in credit card delinquencies at the low-end). McDonald’s (MCD) noted transactions for low-income are running down double-digits and YUM and QSR missed this week. High income holds in a bit better, with MGM/CZR (more low income) noting weak domestic and Vegas trends (down MSD), but WYNN noting relative strength (positive Y/Y). No surprises but notable unevenness.

On Deck - Expected Retail Earnings Next Week

- American Sports - AS: This has some of the highest expectations of the week and are expected to handily beat top and bottom-line and raise the guide. Earnings will tentatively be announced 08/19/2025 before market open. With 10 analysts covering AS, the consensus EPS estimate is $0.03, and the high and low estimates are $0.04 and $0.01, respectively.

- Walmart - WMT: Expectations are for a solid WMT print, with comps in the +4.5% range vs Consensus +4%. Consensus expects the company to reaffirm FY sales and operating income guide, though conviction in a raise is lower vs normal (only due to tariffs with the core solid). WMT continues to be viewed as a winner in consumer retail and their own business should remain solid, but many analysts expect some commentary like MCD last week (more cautious on the US consumer, but with their own business remaining solid). Earnings will tentatively be announced 08/21/2025 before market open. With 29 analysts covering WMT, the consensus EPS estimate is $0.74, and the high and low estimates are $0.9 and $0.69, respectively.

- Home Depot - HD: Analysts we hear from are very constructive the story, but mainly due to the focus on 2026 in their ever increasing exposure to the Pro consumer builders and remodelers. Consensus for the quarter expect a modest SSS miss relative to guidance due to the slower consumer. The focus will be on guidance and current QTD commentary, where there are higher hopes vs the actual 2Q results. Earnings will tentatively be announced 08/19/2025 before market open. With 27 analysts covering HD, the consensus EPS estimate is $4.71, and the high and low estimates are $4.96 and $4.59, respectively.

- Lowes - LOW: More optimism on LOW the last few weeks (better July data), with the street looking for a print similar to HD, in-line to 50 bps light on SSS. The valuation has been attractive on a relative basis and as the housing trade picked up steam the last few weeks so did the stock. Earnings will tentatively be announced 08/20/2025 before market open. With 26 analysts covering LOW, the consensus EPS estimate is $4.25, and the high and low estimates are $4.35 and $4.17, respectively.

- Este Lauder - EL: The stock is +80% since April, but shares shorted are still at 13M, near the highs and vs 8M to start the year. Investors we hear from are optimistic on the story but the large short interest remains. The optimism feels tied to a belief in new management and improving market share trends at both Clinique and Lauder, as opposed to tremendous conviction on this earnings print. A small beat (both sales and EPS) is expected for the quarter but even bulls are prepared for the initial 1Q26 and FY2026 guide to come in a little below consensus. Earnings will tentatively be announced 08/20/2025 before the market open. With 18 analysts covering EL, the consensus EPS estimate is $0.09, and the high and low estimates are $0.22 and $0, respectively.

- Target -TGT: Expectations are the comp should be fine here on a relative basis (-2.5% vs Consensus -3%), but there has been a much more skeptical view building of gross margins the 2nd half of 2Q. Shares shorted have dropped from 20M before last quarter to 15M into this one on the view that top-line could be “ok.” But skepticism remains if sales can actually inflect or are just beating a low bar. Earnings will tentatively be announced 08/20/2025 before market open. With 27 analysts covering TGT, the consensus EPS estimate is $2.05, and the high and low estimates are $2.48 and $1.81, respectively.

- BJ’s Wholesale - BJ: Among the lowest expectations of the retail week. Slightly lower expectations have been dogging the company all quarter long, with an expectation of +2.5% SSS vs Consensus of 3%+. Earnings will tentatively be announced 08/22/2025 before market open. With 18 analysts covering BJ, the consensus EPS estimate is $1.09, and the high and low estimates are $1.18 and $1.04, respectively.

- Off-price (TJX, ROST & BURL): Expectations have been increasing for off-price all quarter long. In rank order, it seems like TJX and BURL have the highest bar, whereas ROST has a lower bar (though all have improved throughout 2Q). For TJX, expectations are for them to handily beat the +2-3% comp guide for 2Q. The only hold-up for investors seems to just be valuation still and modest uncertainty on the tariff impact for Homegoods. For ROST, the question is if their relative struggles are just due to the Hispanic consumer and CA exposure or if there is something more. Expectations feel like they live squarely in the +1-2% range vs the 0 to +3% guidance. BURL is not this week, but they are expected to handily beat comps.

Conclusion

The consumer backdrop remains uneven, with sentiment deteriorating even as retail sales show resilience. Early retail earnings point to sales strength but a more cautious outlook for the balance of the year, particularly as tariff-driven price increases loom. The bifurcation between higher- and lower-income households is becoming more apparent, and while near-term retail performance has pockets of momentum, the second half of 2025 looks increasingly choppy. The upcoming earnings reports in retail land should provide better signals on the overall tone of the consumer psyche.

Rick Imperiale

Writing as The Fair Observer