Is the Much-Anticipated Surge in M&A and Deal Activity Coming?

This week marked a significant up-tick in public-to-public deal activity. The unveiling of several mammoth takeovers that would have never surfaced under the Kahn regime at the FTC have now moved forward in what is widely believed to be a less strident regulatory environment for dealmakers.

In the railroad sector, Union Pacific and Norfolk Southern will combine into a $250 Billion giant which will form the first transcontinental railroad. In the cyber security space, Palo Alto Networks announced the $25 Billion acquisition of Cyber Ark, in a software mega deal. And in the industrials sector, Baker Hughes agrees to buy Chart Industries, a HITR Portfolio holding via the convertible preferred, for an all-cash deal of $13.6 Billion topping rival bidder Flowserve on a go-shop clause. In addition, more than a dozen smaller takeovers and minority stake investments were announced in public deals last week according to data provider Dealogic.

Beyond the public markets, deal activity is beginning to accelerate in the private markets space as well. “There was pent-up demand to transact,” said our long-time friend Michael Arougheti, in an interview with the Financial Times. “Now that you’ve got certainty on the tax bill and enough clarity on the tariff outcomes and constructive capital markets . . . you’ll see people pick up the pen again.”

Michael’s comments come as his company Ares, another HITR convertible preferred holding, reported second-quarter results that showed strong demand for its private credit and real estate funds. On the earnings call he said he expected deal activity will “continue to accelerate” and that the deal market is “thawing”; while noting they raised a net $25.1 Billion in net new deal capital across their funds and products.

Blue Owl, another portfolio holding and a similar smaller version of Ares, noted the acceleration in secondary market deal activity among and between private equity sponsors and continuation funds.

Mark Lipschultz, founder and co-CEO of Blue Owl noted in their earnings call that record levels of activity in secondaries reflected some investors’ treatment of the marketplace as an opportunity to record easy gains. Secondaries deal activity hit a record $102 Billion in the first half of this year, a 42 per cent increase compared with this time last year, according to a recent note by Evercore. Speaking about their secondary business Lipschultz said “Done well, it’s a good business,” noting that rising dealmaking also “reflects an imbalance that is appealing to tap into, which is people got too heavily invested in private equity and now need to lighten the load”. Blue Owl reported second-quarter earnings yesterday (7/31/2025) with growth supported by strong fundraising results, which included raising more than $12 Billion net equity capital during the quarter.

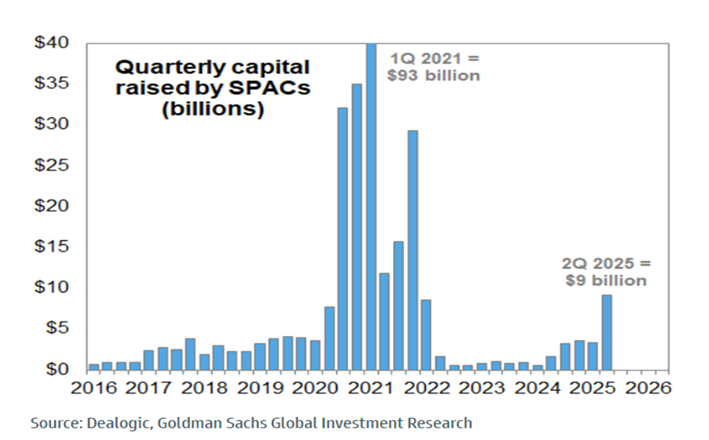

As noted last week by the FO, The SPAC is Back! Any Fair Observer of market data will note that when SPAC’s are easily able to raise large pools of capital, it has foreshadowed accelerated deal activity. The data suggests that the SPAC is back. SPAC activity has increased dramatically, with 2Q 2025 reflecting the largest quarter for SPAC activity since 1Q 2022. 41 offerings raised a total of $9 Billion in the quarter, for a 2025 first half total of $12 Billion.

The IPO window has also reopened. When new deals flood the calendar, and first trade price action is explosive, this suggests exit opportunities for private equity holders. The median US IPO in June rose by 37% in its first trading day, the best month since early 2024 and a top decile relative to the past 3 decades according to Bloomberg News, with 9% being the long-term average.

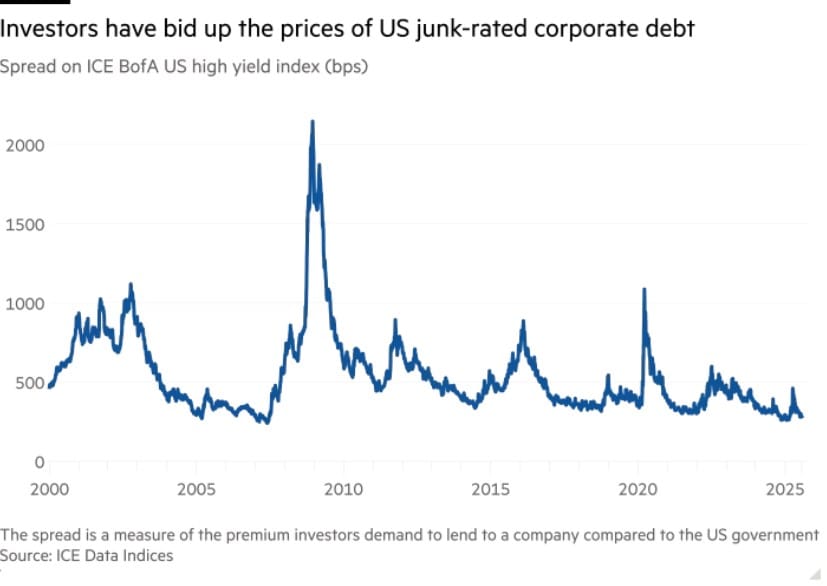

In the meantime, borrowing costs continue to decline while leverage continues to move higher. Reflecting robust debt market flows, US companies are taking advantage of the positive spread conditions in the debt market to lower their borrowing costs, underscoring how many investors are willing to back even risky deals as uncertainty over tariffs eases. Borrowers repriced more than $153.4 Billion of leveraged loans during July, topping the previous record of $152.9 Billion set in December, according to data from Pitch Book. Note that leveraged loans are typically made to already heavily indebted companies, usually backed by private equity.

Leveraged loan spreads, at 4.34% as of Wednesday (7/30/2025), are below the five-year average of 5.08% according to data from JP Morgan Chase. Meanwhile, the gap between yields on junk bonds and US Treasuries has tightened to 2.82% from a high of over 4.55% in April, when tariffs were announced according to Ice Data Services.

Take Aways:

The key takeaway here is that liquidity is abundant, available and flowing into and across both the debt and equity markets. This is leading to an acceleration in deal activity in both the public and private markets. Expect this to accelerate into the second half of the year as liquidity fuels the desire to announce and book deals before yearend. The thirst for profits and bonuses on Wall Street will likely drive this activity.

August 1, 2025

Rick Imperiale

Writing as The Fair Observer

###