Crossing The Chasm

Crossing the Chasm

As the old saying goes, the market climbs a wall of worry-

The exact origin of the phrase seems nebulous at best. I first encountered it in a book entitled “Panic on Wall Street” by Robert Sobel, a professor of history at Hofstra University. In his narrative about the Kennedy Market Slide of 1962, he describes how:

“For a while, Small Business Investment Companies were in vogue. These firms, which had special tax privileges and specialized in investing in unproven firms, captivated speculators in the spring of 1961…. With all of this, there were signs of fear in the autumn of 1961. It took subtle forms and did not cause a break on Wall Street as the market continued to climb a wall of worry. As the economy continued to perform well. And such notables as United States Trust Company were cautiously optimistic about Wall Street developments, economists and business writers began to discuss the profit squeeze. Business Week noted that from 1958 to 1961, federal spending had increased by 20.4%; GNP by 19.6%, corporation sales were up 18.7% and payrolls by 18.9%. In this same span, corporation profits increased only 3%. Yet stock prices moved higher, buoyed by fantastic and glamorous tales of the future. Repeating what had been a standard Wall Street joke, the Journal noted that stocks were not only discounting the future, but the hereafter as well.”

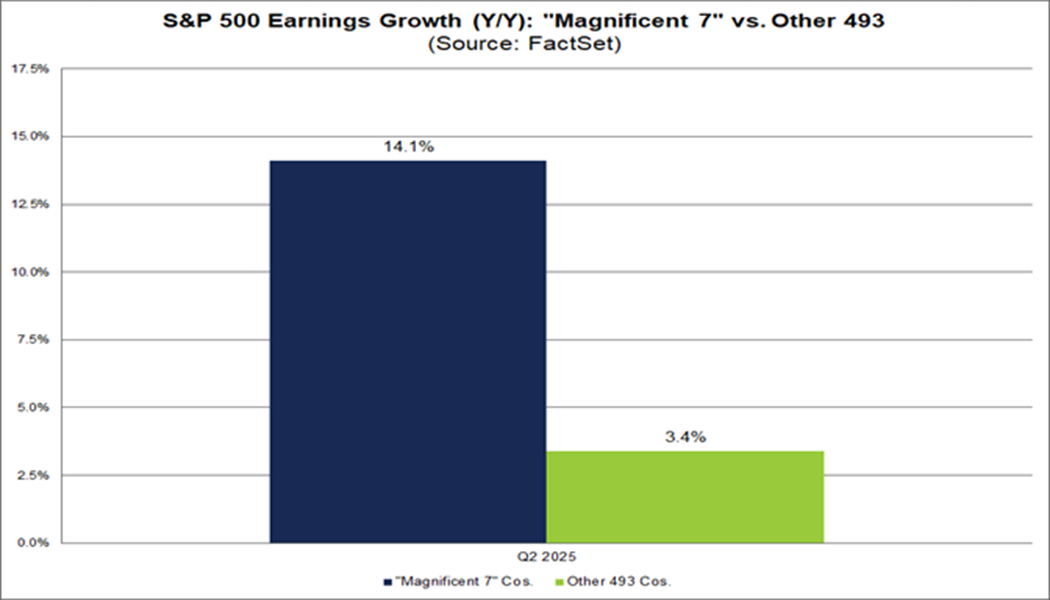

I call this out because so many elements of what Sobel noted about 1962 seem to match a corollary in the current market environment with federal spending growth, and when the earnings of the Mag 7 are removed from the S&P 500 earnings for the year-to-date through 2Q, earnings growth is 3.4% for the remaining 493 constituents. While the Market Climbs a Wall of Worry.

The market lives in the future, and as such there are some events that create a chasm for the market to cross in order to move materially higher.

Fed Rate Cut(s) the Fed appears set to cut -- into a cyclical upswing. Interest rate markets expect the Fed to deliver a rate cut this week with nearly 100% certainty. The markets currently are discounting five rate cuts between now and the middle of 2026. There seems to be little debate about this happening, but the tone of the Fed’s comments will certainly be key to crossing the chasm. Don’t Fight the Fed!

Budget Ceiling – Facing a September 30, budget ceiling, Congress will need to approve a short-term stopgap spending bill of face a government shutdown. Senate Democratic Leader Chuck Schumer says he and House Democratic Leader Hakeem Jeffries are united in opposing any legislation that doesn’t include key health care provisions and a commitment not to roll them back. He argues that the country is in a different place than it was in March, when he vigorously argued against a shutdown. The looming Schumer Shutdown must be avoided.

Slowing Jobs Growth - Greater uncertainty around both the true pace of jobs growth, because of low response rates and large revisions to the establishment survey, and the breakeven rate (because of the big ups and downs of immigration in recent years) has increased the importance of the unemployment rate relative to payrolls, even on a month-to-month basis. This will likely need to hold steady to convince the market that the economy is stable and not contracting.

Geopolitical Conflict – With the world order in upheaval, a world of global conflict is more intense and widespread now than in decades. The scale of suffering, displacement, and economic damage is large and continues growing. Peace settlements and ceasefires do seem imminent, but durable resolutions that settle key issues in a way accepted by all major parties remain rare in many of the largest or most intractable conflicts. The outlook is mixed: some pathways to peace exist, but they often depend on strong external diplomacy, willingness to compromise, and conditions (political, economic, social) that are hard to engineer. The market seems numb to this situation. But an escalation in one of many places could change market sentiment in an instant. It was just April, when the market dropped 20% and the VIX climbed to over 60. Thes changes in sentiment can happen quickly.

AI Spending – It seems the marginal growth of the US economy is currently driven by AI capital spending. Last week Oracle issued a surprisingly strong earnings report supported by corporate AI capital spending. All AI reports were nearly universally positive this earnings season (both on spending and on usage / monetization), only to be further underscored by ORCL’s historic earnings print and the market reaction sending the stock up 33% in a single day. TMT companies have been increasingly comfortable speaking to out-year(s) AI revenues (and expected expenditures). Any change in this positive sentiment could be highly problematic for the market given the outlook and expectations built up around the AI trade. The AI narrative must remain intact.

In summary what might get the market over the “Wall of Worry”?

1. Fed Rate Cut(s)

2. Budget Ceiling Resolution

3. Stable/Improving Jobs Outlook

4. Reduction in Geopolitical Tensions

5. Continued AI Capital Spending

Conclusion

Markets thrive on navigating uncertainty, but history suggests that crossing key inflection points often determines whether optimism holds or unravels. In 1962, as Sobel observed, investors overlooked profit squeezes and leaned on hope for the future; today, the Mag 7’s outsized earnings and AI-fueled narratives play a similar role. Yet the structural risks—budget brinkmanship, labor market ambiguity, geopolitical instability—remain unresolved. Whether these risks become catalysts for volatility or fade into the background will depend on the Fed’s tone in coming weeks, Congress’s ability to prevent a shutdown, and the resilience of both consumers and corporate investment. The markets may indeed continue to climb the proverbial wall of worry, but their ability to cross the chasm will hinge on a few key events.

All eyes on the Fed and Congress as we move through the next two weeks.

Rick Imperiale

Writing as The Fair Observer

September 15, 2025