Could Earnings Expectations Be Too High?

The current market narrative among the pundit class is “look at earnings, which are coming in much better than expected” which leads to the conclusion that better earnings are driving the market higher.

The current market narrative among the pundit class is “look at earnings, which are coming in much better than expected” which leads to the conclusion that better earnings are driving the market higher.

But, there are some interesting datapoints that could indicate that earnings expectations may in fact be too high.

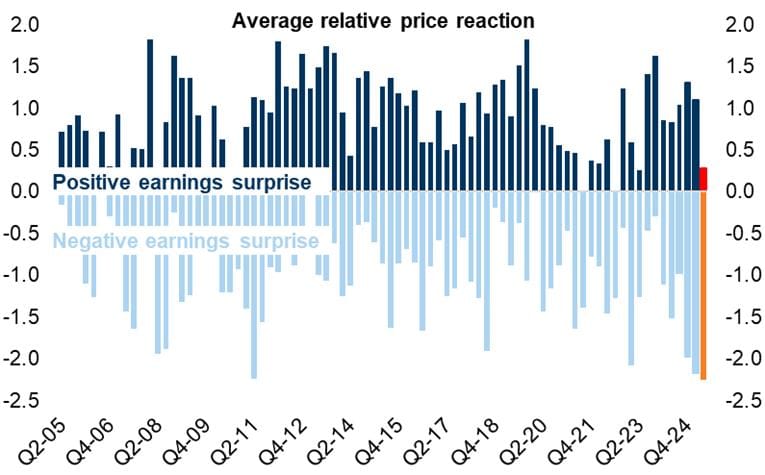

QTD, the reaction of stocks that beat earnings has been far more subdued than the reaction of those that miss earnings.

More interestingly, for the first time in the eighteen-year history of the dataset, S&P500 stocks in aggregate are posting earnings day moves greater than their implied option volatility. It appears that the commonly held idea that “options are perpetually too expensive” proved incorrect this quarter so far. The average S&P 500 stock moved +/-5.3% (15-yr highs), higher than the options implied move of +/-4.7% (2-yr lows), on a like-for-like basis. These high implied moves suggest that investors are uncomfortable or unsure (low conviction) with their positioning which causes high single stock volatility despite a relatively calm VIX.

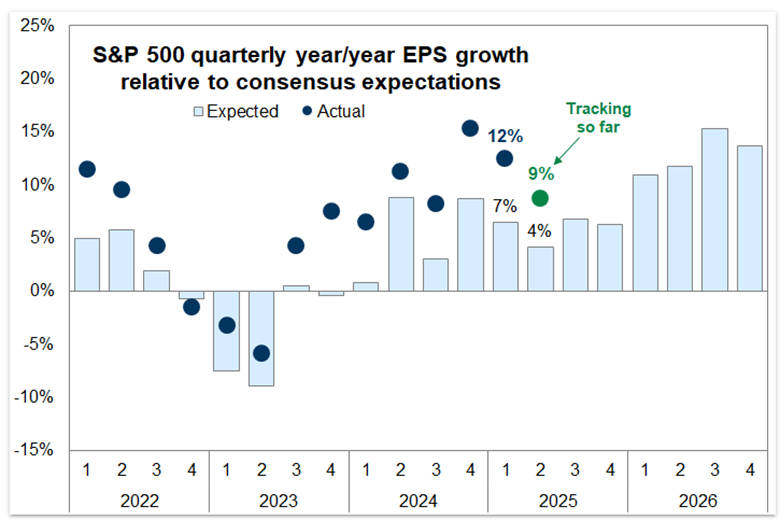

The setup here looks interesting, a relatively low bar with Q2 S&P earnings growth set at 4% going into the reporting season. Post reporting, EPS revisions have been strong but coming off this low base.

Given the expectation that Y/Y earnings for Q3 are expected to be near 13%, and accepting the argument that expectations for Q2 may have actually been too high given market action around single stock names, is it possible that Q3, given the high level of valuation and the expected earnings growth, turns into a market disappointment? If Companies fail to exceed the published numbers, and revisions actually trend downward, could the market correct going into yearend?

For Q2 2025 S&P 500 companies reported year-over-year earnings growth of 10.3% and revenue growth of 6.0%. For the upcoming Q3 2025, analysts are projecting earnings growth of 12.6% and revenue growth of 5.5%. However, these numbers are heavily influenced by the "Magnificent Seven" tech companies, which saw 26% earnings growth in Q2, while the rest of the S&P 500 grew at a slower 4%.

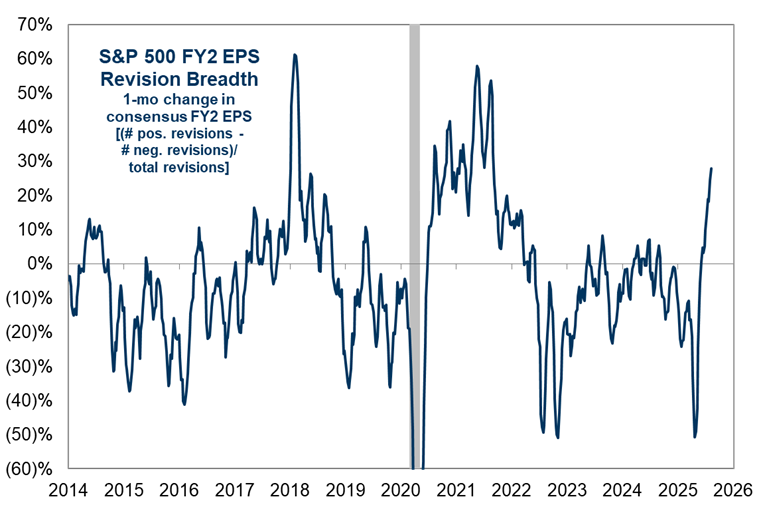

The strength of reported results and corporate guidance have triggered a sharp and broad-based upward revisions to analyst 2026 EPS estimates in recent weeks.

Earnings revision breadth, which measures the relative frequency of upward vs. downward revisions to year-ahead analyst estimates, fell sharply earlier this year following initial tariff announcements.

A common theme underlying the positive corporate guidance is management’s confidence in their ability to mitigate the tariff headwind. When discussing the impact of tariffs on their business, 27% of firms explicitly noted a decline in expected profit headwind from tariffs relative to previous management estimates. Many of these companies attributed the improvement in outlook to the decline in tariff rates relative to levels announced earlier in the year.

Given the potential headwinds of tariffs, which are now just beginning to work their way into the supply chain, and the large disparity between big cap tech earnings growth and the broader market, it may be hard to meet the “whisper numbers” for 3Q that seem to be too high given the empirical data observed this earnings period. Will the market continue to be bifurcated with the top ten names continuing to grow in relative weight to the bottom 490?

Given the data, a Fair Observer might conclude that Q3 earnings season is set up to trigger disappointment among investors given the indications of high expectations and the reality of the operating environment.

August 8, 2025

Rick Imperiale - Writing as the Fair Observer